Share this

Getting Started with DeFi Protocols

What is DeFi Protocol?

A DeFi Protocol, or Decentralized Finance Protocol, is a system within the decentralized finance (DeFi) space that operates without a central authority. Unlike traditional financial systems which typically feature a centralized institution like a bank managing all transactions and funds, DeFi processes run through intermediaries that facilitate financial services without directly managing customers’ funds.

DeFi offers financial services similar to traditional finance systems, including lending, decentralized exchanges (DEXes) for trading various digital assets, yield farming, and derivatives trading.

One notable aspect of DeFi Protocols is the emergence of Liquid Staking, which involves depositing assets like Ethereum (ETH) to earn rewards from staking without the need to lock them up. This sector has seen rapid growth and innovation in recent years.

Analyzing tokens within the DeFi space typically involves looking at metrics such as Total Value Locked (TVL), which indicates the amount of assets locked within a DeFi Protocol. Additionally, on-chain data measuring revenue generated within the protocol, and partnerships with various businesses reflect the strength and adoption of the protocol.

🪙Some noteworthy tokens in the DeFi space include:

1.Liquid Staking: Lido DAO (LDO) is a leading protocol in this category, holding over 30% of all ETH staked.

2.Decentralized Exchanges: Protocols like Uniswap (UNI), Sushiswap (SUSHI), PancakeSwap (CAKE), and Curve Finance (CRV) dominate the market.

3.Derivatives: DYDX and Synthetic (SNX) are prominent in this sector.

4.Lending: Maker (MKR), Compound (COMP), and Aave offer lending and borrowing services.

It’s important to note that some protocols may offer multiple DeFi services by expanding their offerings through additional features and integrations. Investors should continuously research and follow developments to make informed decisions.

In 2024, it remains to be seen how DeFi Protocols will further develop technologically. There may be projects that might drive mass adoption, potentially shaping new narratives within the DeFi space.

Share this

- January 2026 (8)

- December 2025 (15)

- November 2025 (5)

- October 2025 (13)

- September 2025 (9)

- August 2025 (12)

- July 2025 (19)

- June 2025 (11)

- May 2025 (11)

- April 2025 (15)

- March 2025 (11)

- February 2025 (15)

- January 2025 (9)

- December 2024 (10)

- November 2024 (8)

- October 2024 (9)

- September 2024 (7)

- August 2024 (16)

- July 2024 (3)

- June 2024 (46)

Subscribe by email

สหรัฐฯ ประกาศย้ำจุดยืนเป็นเมืองหลวงคริปโตของโลก

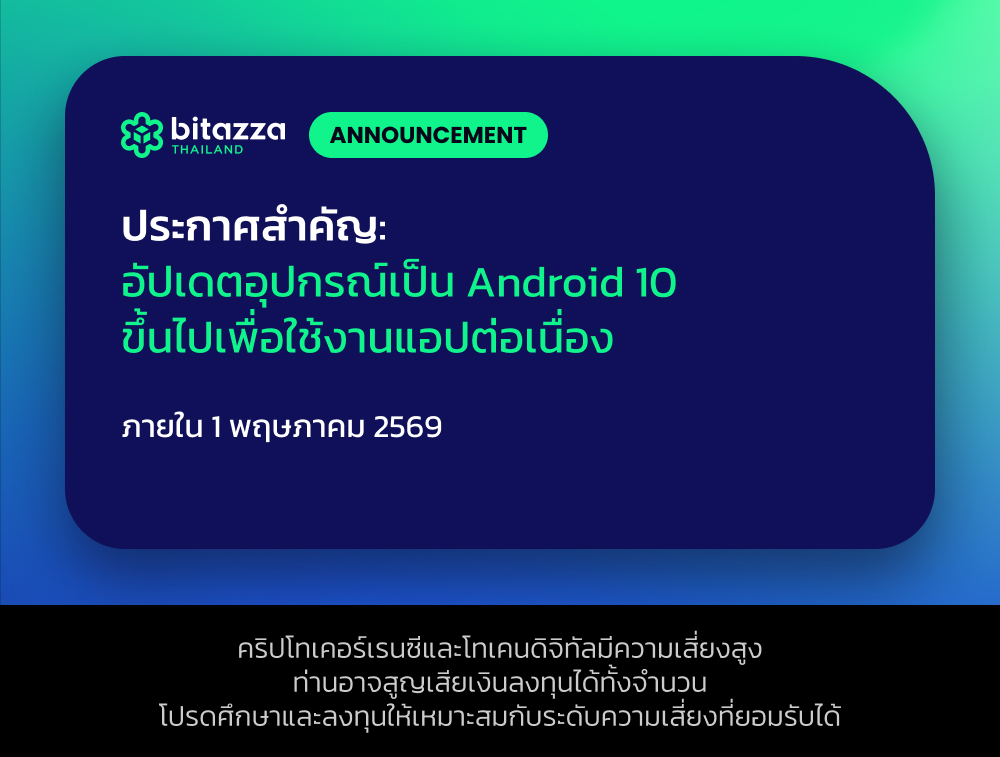

อัปเดต Android เพื่อใช้งานแอป Bitazza Thailand ต่อเนื่อง

CTXC Coin คืออะไร? เจาะลึก Cortex บล็อกเชน AI และอัปเดตข่าวล่าสุด 2026

Bitazza ขยายโครงสร้างพื้นฐาน USDT ผ่านการผสานเครือข่าย Kaia Blockchain

เจาะลึก XAI Coin คืออะไร? สรุปข่าวล่าสุด ระบบนิเวศ และแนวโน้มราคาปี 2026

ชวนอัปเดต ZETA Coin จากอดีตเหรียญน้องใหม่สู่ปี 2026

ถอดวิกฤตเหรียญ LUNA จากดาวรุ่งสู่ดาวร่วง

จับตาอนุมัติกฎหมาย CLARITY Act หนุนตลาดคริปโตขาขึ้น

รู้จัก WAN Coin เหรียญลับโลก Cross-Chain ใน 3 นาที